Home Staging FAQ: What You Need To Know

You may have heard that staging your home properly can make a big difference when you sell your house, but what exactly is home staging, and is it really worth your time and effort?

Here are a few quick FAQs that can help you decide how much you should prioritize staging as you prep for your move.

What Is Home Staging?

Staging is the process of arranging and decorating your house to highlight its best features and make it as appealing as possible to potential buyers. It can range from simple touch-ups to more extensive setups, depending on your needs and budget.

How Does It Help Me Sell My House?

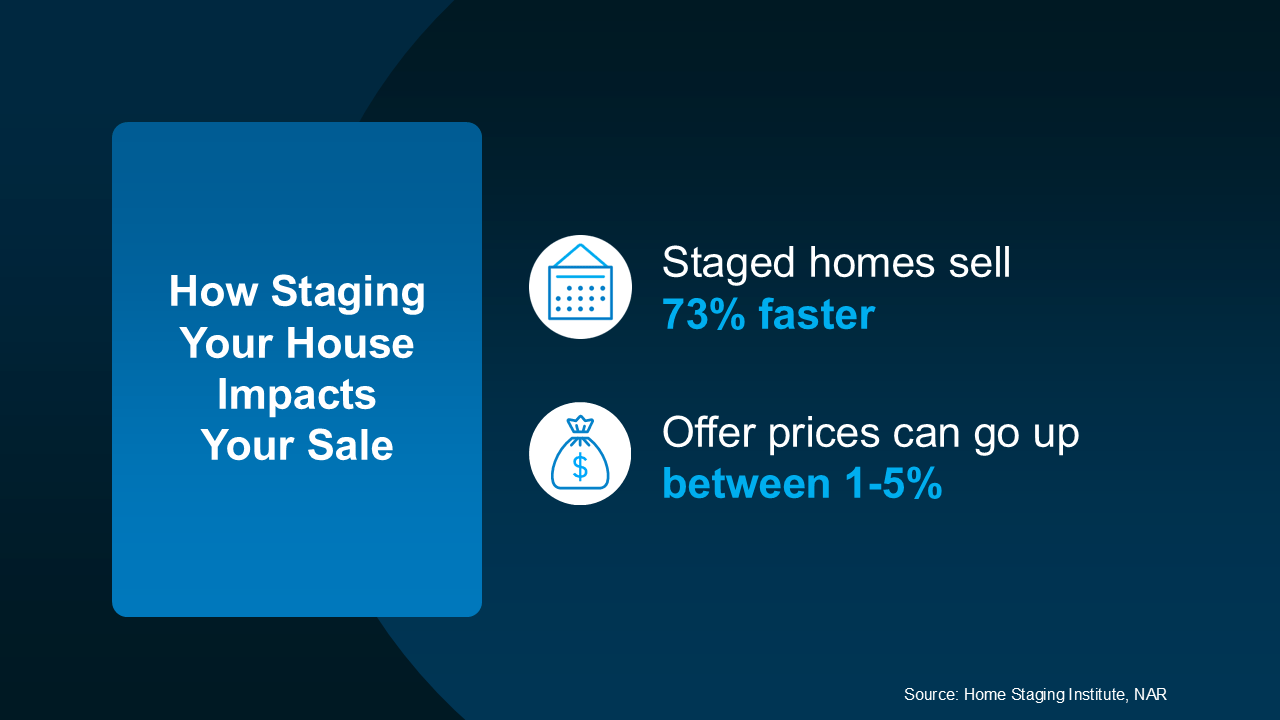

Studies show good staging does have an impact on your sale. Staging your house well can help you attract more attention from buyers, which ultimately helps it sell faster and maybe for a higher price than an unstaged home (see visual):

What Are My Staging Options?

What Are My Staging Options?

Now that you see the value, let’s think through your options. The most common is leaning on your agent for their expert advice. They know what buyers like because they’re in showings all the time and hear that feedback first-hand. That expertise is crucial to getting your house market-ready. Basic staging with an agent usually means they give you insight into how you should:

- Declutter and depersonalize by removing photos and personal items

- Arrange your furniture to improve the room’s flow and make it feel bigger

- Add plants, move art, or re-arrange other accessories

Full-service staging is another option if your house needs more hands-on attention. This is when you hire a staging professional or staging company to come in, make recommendations, and do the work for you. Going this route is more involved and that makes it more costly too. That’s because it can include renting furniture and decor to more fully transform a space.

How Do I Know Which One To Pick?

Not sure which one you need? You don’t have to figure that out on your own. Your real estate agent will help determine what level of staging will make the most impact on your house and market.

They can help you decide if professional staging is worth the investment, or if you can knock it out with their advice alone. And just so you know, here are some of the factors an agent will look at to figure that out:

- Market Conditions: If the market is slower, going all in on staging can make your home look move-in ready and attractive to buyers who may otherwise be hesitant. If your local market is very active and homes are selling fast, you may be able to get by with doing less.

- Your Home’s Condition: If your home is vacant or has a unique layout, using a professional stager who can bring in the right furniture and accessories may help buyers truly visualize its full potential.

- Your Budget: Talk to your agent to get an idea of staging costs in your area, as it can be the difference between your house selling and sitting. But if your budget is tight or your home only needs minor updates, your real estate agent can help you think outside of the box by suggesting simple DIY staging tips to help your home look its best.

Bottom Line

Staging your house properly can make it much more attractive to buyers, but it’s not a one-size-fits-all solution, and every home shines differently. Let’s connect to talk through what your home really needs to stand out and sell for top dollar.

Should You Sell Your House As-Is or Make Repairs?

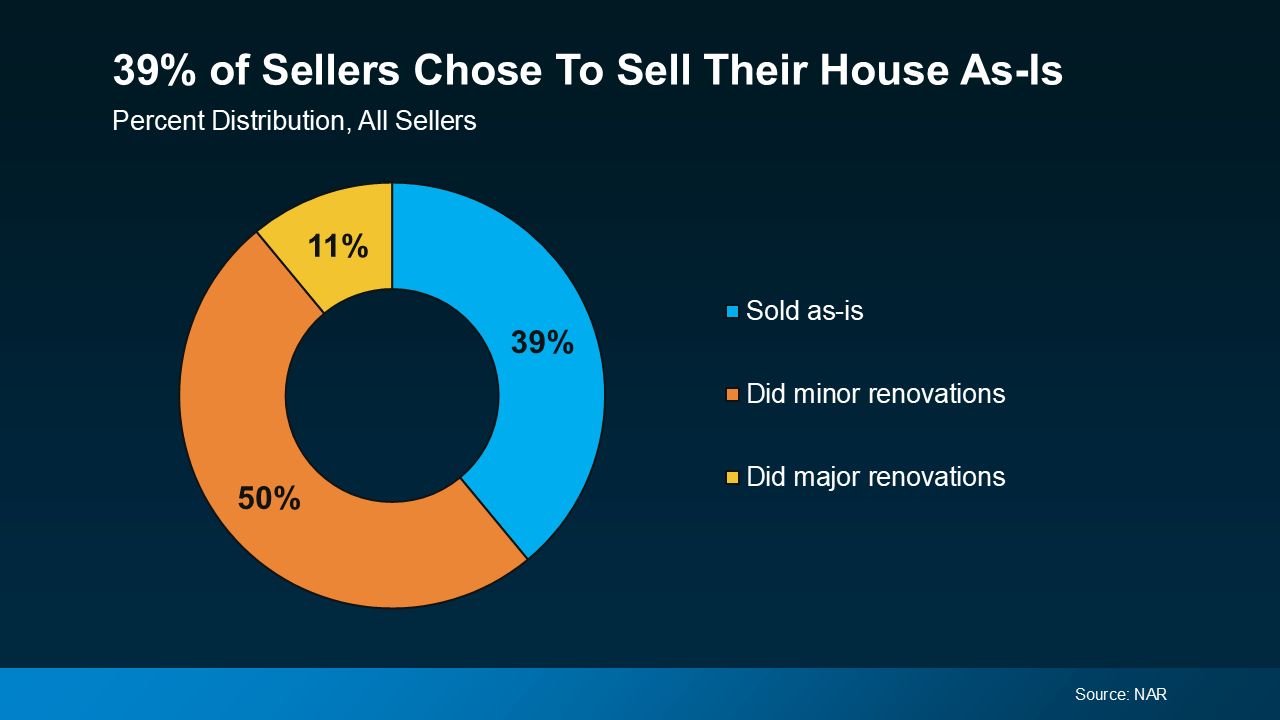

A recent study from the National Association of Realtors (NAR) shows most sellers (61%) completed at least minor repairs when selling their house. But sometimes life gets in the way and that’s just not possible. Maybe that’s why, 39% of sellers chose to sell as-is instead (see chart below):

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

If you’re feeling stressed because you don’t have the time, budget, or resources to tackle any repairs or updates, you may be tempted to sell your house as-is, too. But before you decide to go this route, here’s what you need to know.

What Does Selling As-Is Really Mean?

Selling as-is means you won’t make any repairs before the sale, and you won’t negotiate fixes after a buyer’s inspection. And this sends a signal to potential buyers that what they see is what they get.

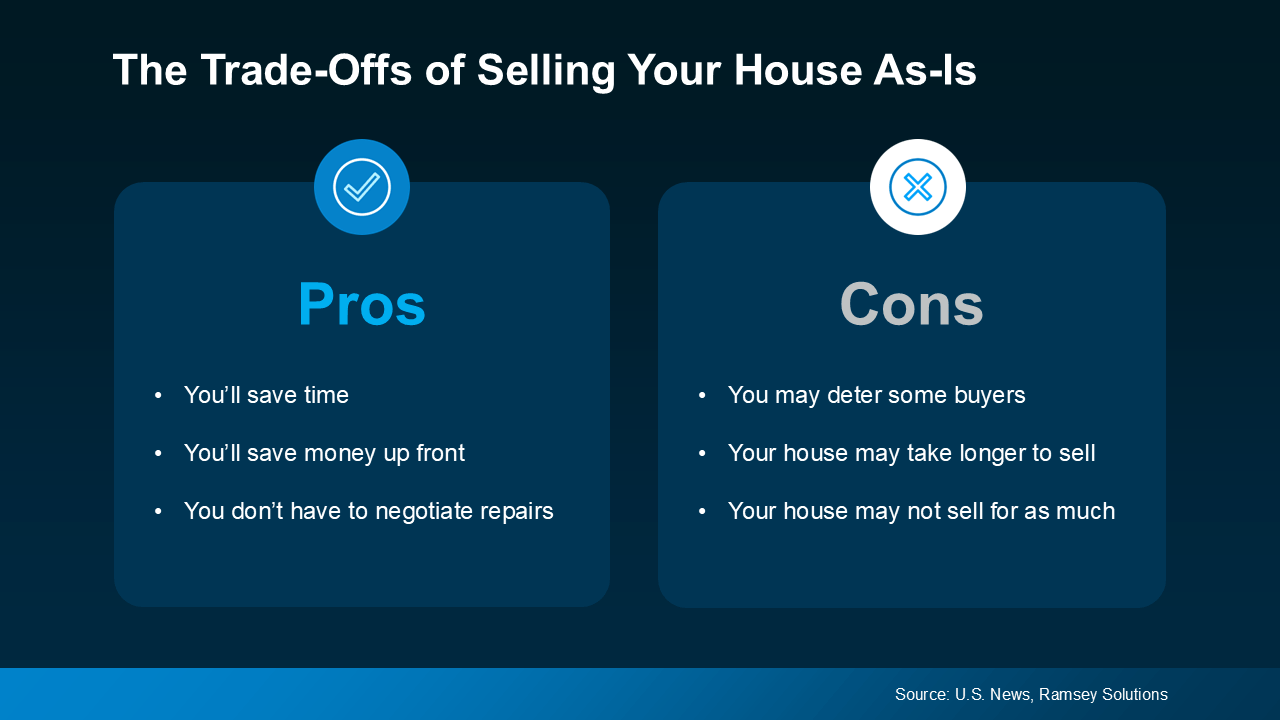

If you’re eager to sell but money or time is tight, this can be a relief because it’s that much less you’ll have to worry about. But there are a few trade-offs you’ll have to be willing to make. This visual breaks down some of the pros and cons:

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

Typically, a home that’s updated sells for more because buyers are often willing to pay a premium for something that’s move-in ready. That’s why you may find not as many buyers will look at your house if you sell it in its current condition. And less interest from buyers could mean fewer offers, taking longer to sell, and ultimately, a lower price. Basically, while it’s easier for you, the final sale price might be less than you’d get if you invested in repairs and upgrades.

That doesn’t mean your house won’t sell – it just means it may not sell for as much as it would in top condition.

Here’s the good news though. In today’s market, as many as 56% of buyers surveyed would be willing to buy a home that needs some work. That’s because affordability is still a challenge, and while there are more homes for sale right now, inventory is lower than the norm. So, you might find there are a few more buyers who may be willing to take on the work themselves.

How an Agent Can Help

So, how do you make sure you’re making the right decision for your move? The key is working with a pro.

A good agent will help you weigh your options by showing you what comparable homes in your area have sold for, what updates your neighbors are making, and guide you in setting a fair price no matter what you decide. That helps you anticipate what your house may sell for either way – and that can be a key factor in your final decision.

Once you’ve picked which route you’re going to go and the asking price is set, your agent will market your house to maximize its appeal. And if you decide to sell as-is, they’ll call attention to the best features, like the location, size, and more, so it’s easy for buyers to see the potential, not just projects.

Bottom Line

Selling a home without making any repairs is possible in today’s market, but it does have some trade-offs. To make sure you’re considering all your options and making the best choice possible, let’s have a conversation.

Don’t Miss Out on the Growing Number of Down Payment Assistance Programs

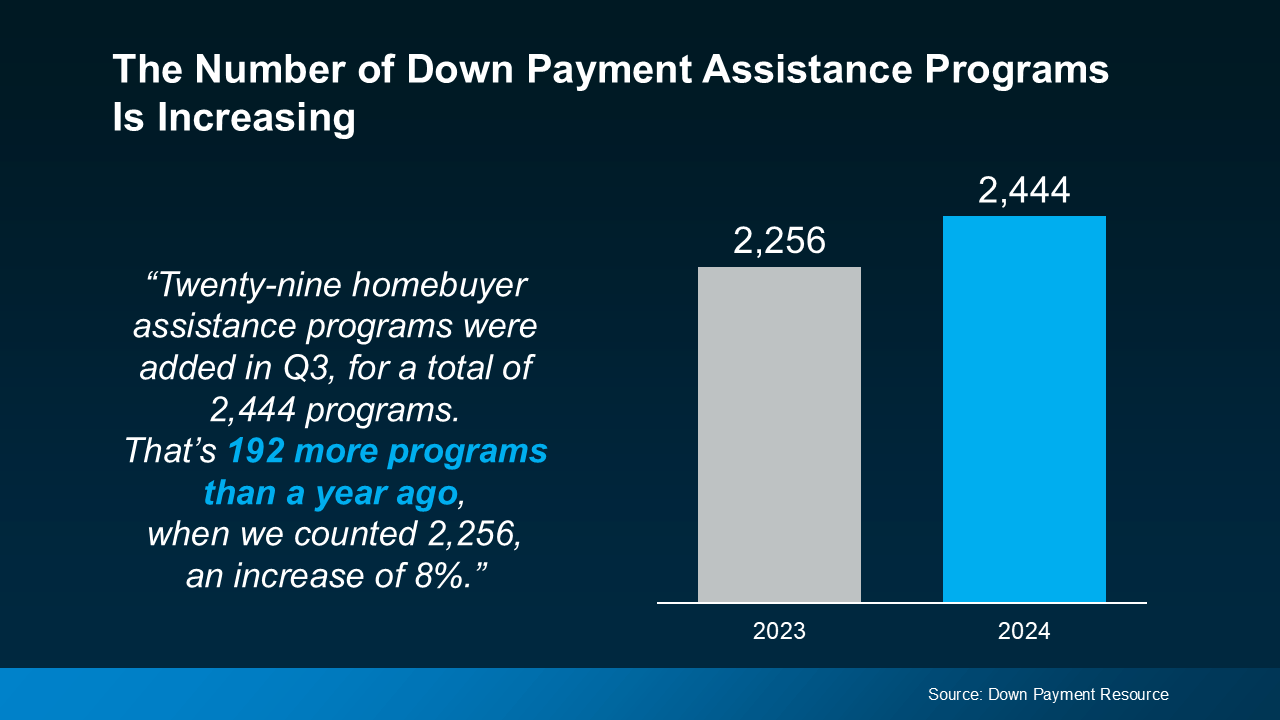

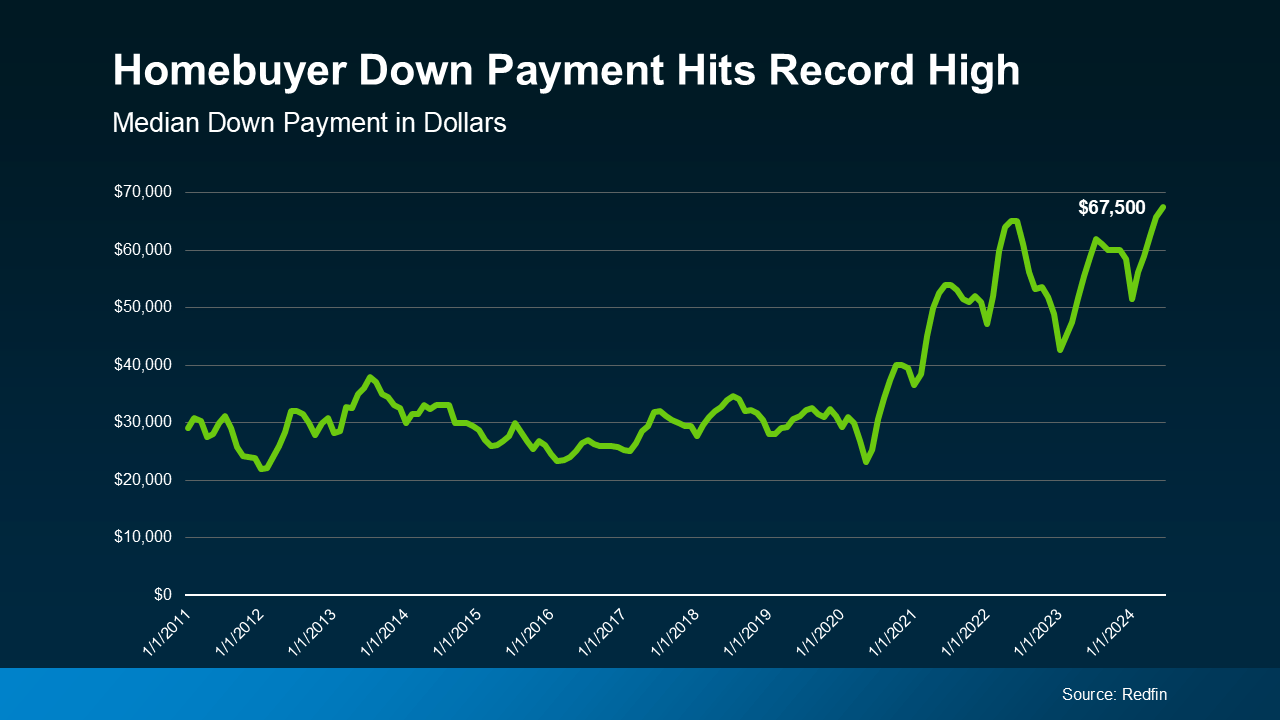

With rising home prices and volatile mortgage rates, it’s important you know about every resource that could help make buying a home possible. And one thing you’ll want to be aware of is just how much the number of down payment assistance (DPA) programs has grown lately.

Take a look at the graph below to see how many new programs have been added in the last year, according to data from Down Payment Resource:

More Programs, More Opportunities for You

So, what does this increase mean for you? With more programs available, there’s a higher likelihood that one of them could help you reach your homeownership goals.

And these programs aren’t small-scale help either – the benefits can go a long way toward covering a chunk of your costs. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“We are pleased to see a growing number of these programs, and think they are becoming a targeted way to help first-time and first-generation homebuyers struggling to save for a down payment get into a home they can afford. Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine being able to qualify for $17,000 toward your down payment—that’s a big boost, especially if you’re looking to buy your first home. With that level of help, buying a home may be more within reach than you think.

But it’s worth calling out that the growth in DPA options isn’t just focused on first-time and first-generation buyers. Many of the new programs are also aimed at supporting affordable housing initiatives, which include manufactured and multi-family homes. This means that more people, and a wider variety of home types, can qualify for down payment assistance, making it easier for you to find an option that fits your needs.

Talk to a Real Estate Expert About What’s Available for You

With so many DPA programs out there, you need to make sure you’re finding the right one for you. That’s why it’s key to lean on your real estate and lending professionals for guidance. The Mortgage Reports says:

“The best way to find down payment assistance programs for which you qualify is to speak with your loan officer or broker. They should know about local grants and loan programs that can help you out.”

Your loan officer or real estate agent will know what’s available in your area and can point you toward programs that align with your goals.

Bottom Line

With more down payment assistance programs than ever before, now’s a great time to explore how these options can help on your homebuying journey. Let’s work together to make sure you’ve got a team of expert advisors in place to see which DPA programs could be a fit for you.

Don’t Let These Two Concerns Hold You Back from Selling Your House

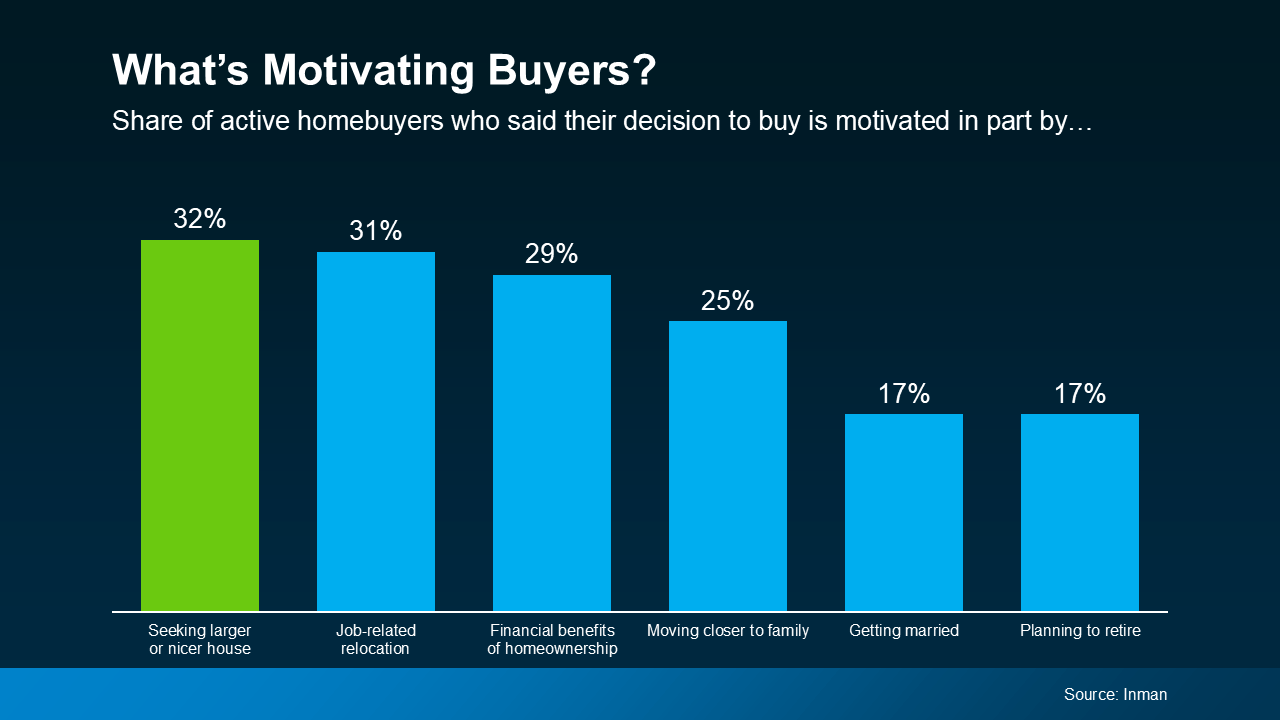

If you’re debating whether or not you want to sell right now, it might be because you’ve got some unanswered questions, like if moving really makes sense in today’s market. Maybe you’re wondering if it’s even a good idea to move right now. Or you’re stressed because you think you won’t find a house you like.

To put your mind at ease, here’s how to tackle these two concerns head-on.

Is It Even a Good Idea To Move Right Now?

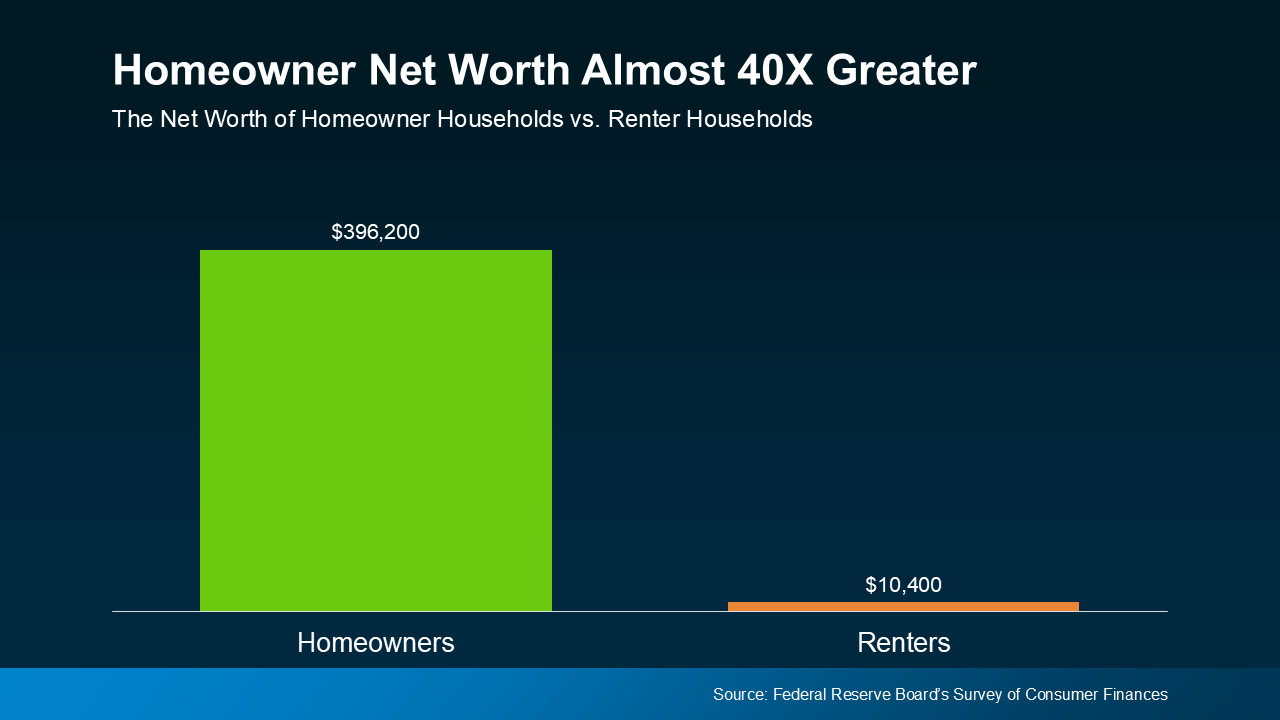

If you own a home already, you may have been holding off because you don’t want to sell and take on a higher mortgage rate on your next house. But your move may be a lot more feasible than you think, and that’s because of your equity.

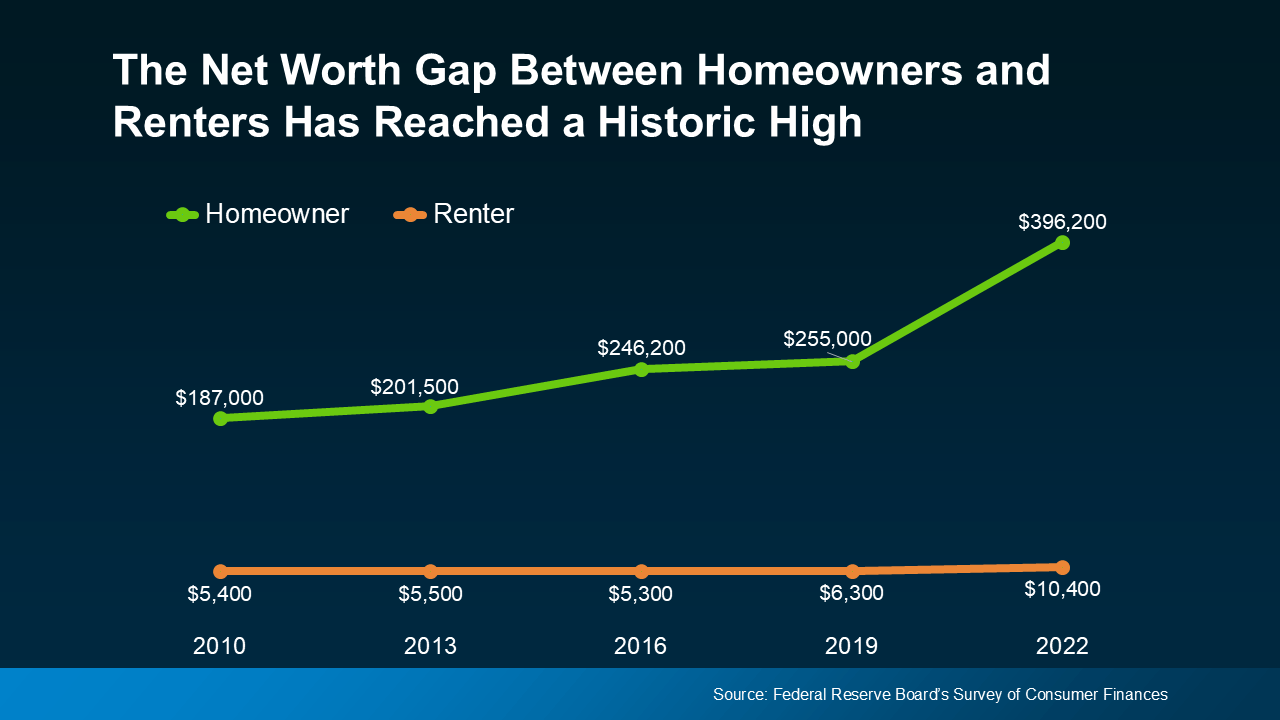

Equity is the current market value of your home minus what you still owe on your loan. And thanks to the rapid appreciation we saw over the past few years, your equity has gotten a big boost. Just how much are we talking about? See for yourself. As Dr. Selma Hepp, Chief Economist at CoreLogic, explains:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

Here’s why this can be such a game-changer when you sell. You can use that equity to put down a larger amount on your next home, which means financing less at today’s mortgage rate. And in some cases, you may even be able to buy your next home in cash, avoiding mortgage rates altogether.

The bottom line? Your equity could be the key to making your next move possible.

Will I Be Able To Find a Home I Like?

If this is on your mind, it’s probably because you remember just how low the supply of homes for sale got over the past few years. It felt nearly impossible to find a home to buy because there were so few available.

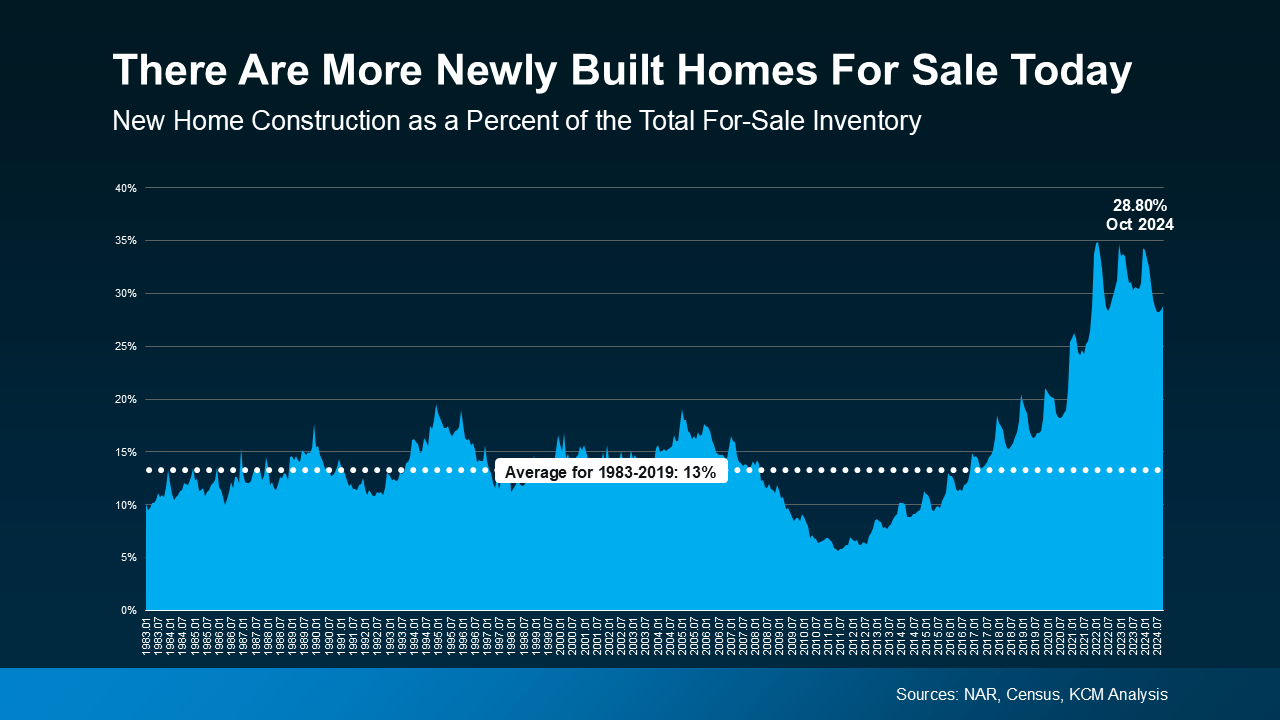

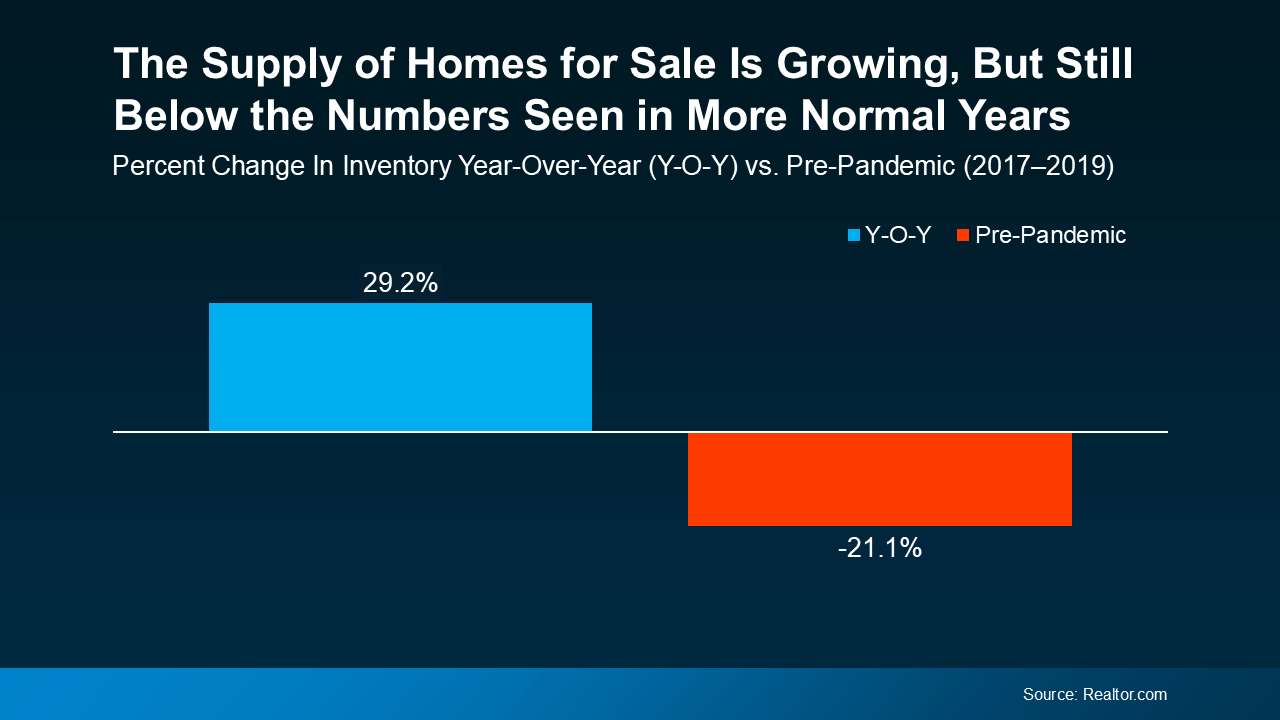

But finding a home in today’s market isn’t as challenging. That’s because the number of homes for sale is growing, giving you more options to choose from. Data from Realtor.com shows just how much inventory has increased – it’s up almost 30% year-over-year (see graph below):

And even though inventory is still below pre-pandemic levels, this is the highest it’s been in quite a while. That means you have more options for your move, but your house should still stand out to buyers at the same time. That’s a sweet spot for you.

It’s important to note, though, that this balance varies by local market. Some places may have more homes for sale than others, so working with a local real estate agent is the best way to see what inventory trends look like in your area.

Bottom Line

How Much Does It Cost To Sell My House?

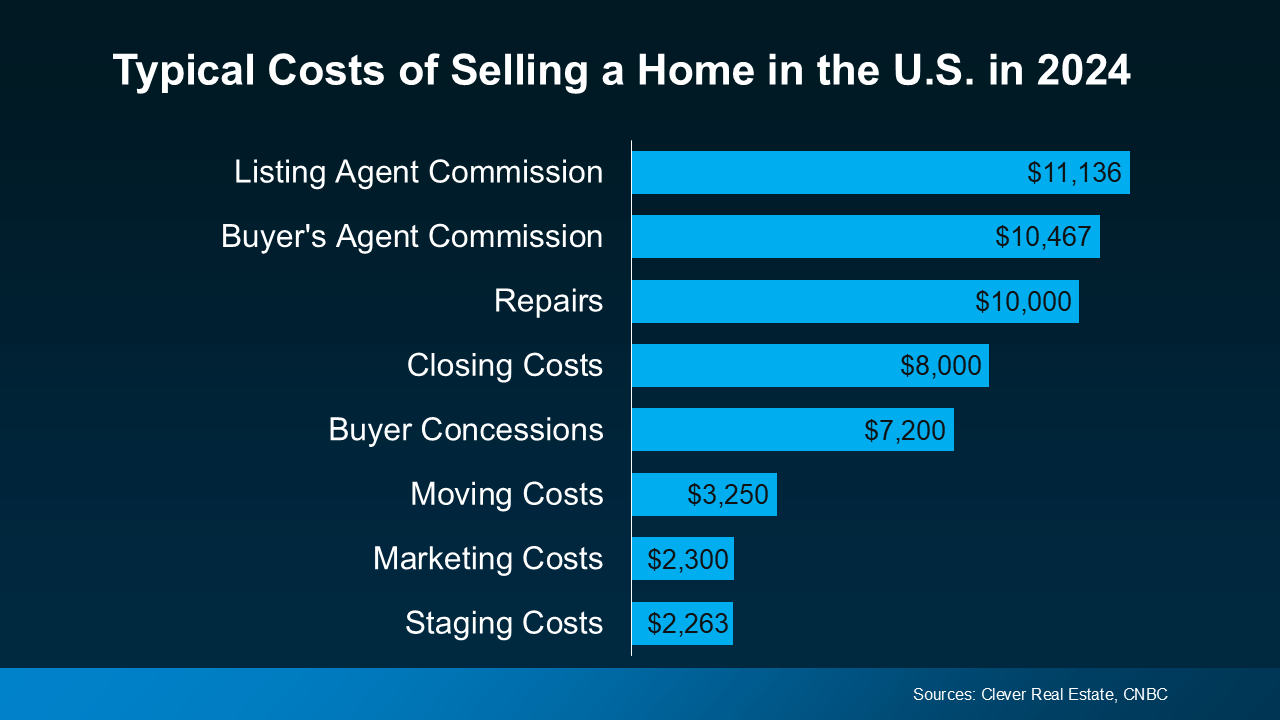

If you’re toying with the idea of selling your house, you’re probably wondering how much it’ll cost. To be honest, the final number will depend on several factors like the offer you accept, if you help with your buyer’s closing costs, how many repairs you tackle, and more.

So, to give you a ballpark of what to expect, here’s some information on a few of the expenses you’ll want to be ready for (see graph below):

But here’s something that puts those costs into perspective. Most homeowners today have a substantial amount of equity built up in their homes, and that means they stand to make significant gains when they sell. Chances are, you do too. This can help quickly recoup these selling costs. You may even have enough equity leftover to put some toward your next home purchase too.

Let’s dive into a few of the costs from the graph above, so you have a bit more context on what they include and where you may be able to save some money, when it makes sense.

Closing Costs and Commission

These are the fees you’ll pay at the closing table to cover various aspects of the sale. You’ll have your own closing costs and you may even offer to pay some of the buyer’s as a concession. As U.S. News Real Estate explains:

“Closing costs are fees that are paid to finalize the transaction and transfer ownership of the home to the buyer . . . Sellers can expect to pay 2% to 4% of the sale price of the home in fees and taxes on top of the agent commission. Based on the national median home sale price, this means that closing costs in 2023 for sellers are about $7,740 to $15,480. . .”

Taxes are going to vary by state and agent commissions depend on what you agree upon upfront. And keep in mind, that the numbers in the chart above are just an example, not exact figures. Not to mention, if you put money toward things like your property taxes, mortgage escrow, etc. as part of your current mortgage payments – there’s a chance you’ll get a credit back at closing that can help offset some of these selling expenses.

Pre-Listing Inspection and Repairs

One optional step some sellers take is having a pre-listing inspection. It gives you an idea of what may pop up later on in the buyer’s inspection – because those are the items a buyer may ask you to toss in a credit (or concession) to cover later on.

This allows you to get a jump on any repairs and tackle them before you list, so your house is set up to impress from the start.

Again, if you want to skip this step, an agent can help. They’ll be able to give you advice on things like paint colors, small cosmetic repairs, what buyers are looking for, and whether it’s worth tackling anything else ahead of time. This will help make sure you’re spending money on things that are most likely to net you a solid return on your investment.

Home Staging

As inventory grows, you may want to take a few extra steps to make sure your house stands out. Staging is an optional way to make sure your house shows well. It can include bringing in rental furniture if the house is vacant or art to warm up the walls. Some staging can even be done virtually once the photos are taken. But, in general, how much does it cost? According to Bankrate:

“Home sellers typically pay somewhere between $782 and $2,817 in home staging costs . . . but the price tag can vary widely.”

If you want to skip this step, you could opt to lean on your agent’s advice for what looks good and what may feel cluttered. A great agent will suggest things like removing a chair to open up the flow of a room, laying down a rug to add warmth to a space, or taking down photographs to de-personalize strategic areas.

Why Leaning on an Agent Is Key

If you’re looking to cut down on your costs, you have options. But be careful of where you trim. You may be able to skip staging or a pre-listing inspection since those are optional, but you don’t want to skimp and sell without a pro.

An agent is your go-to expert throughout the transaction. They’ll offer customized advice every step of the way, including how to stage the house and what repairs to tackle. This can help you avoid hiring an outside stager or having to pay for a pre-listing inspection.

But that’s not the only way your agent adds value. They’ll also create tailored marketing and pricing strategies that’ll highlight the house’s best assets and any work you did to get the home show ready. And that can actually help your house sell for more in the long run.

Bottom Line

Want a better picture of what you should expect when you sell your house? Let’s have a conversation and walk through it together.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

What Are My Staging Options?

What Are My Staging Options?