Is Your House Priced Too High?

Every seller wants to get their house sold quickly, for as much money as they can, with as few headaches as possible. And chances are, you’re no different.

But did you know one of the biggest things that could jeopardize your success is the asking price for your home? Pricing your house correctly is one of the most crucial steps in the selling process.

So, how do you know if you’re missing the mark? Here are four signs your high asking price might be turning potential buyers away—and why leaning on your real estate agent is the best way to course correct.

1. You’re Not Getting Many Showings or Offers

One of the most obvious signs your house may be overpriced is a lack of showings. If it’s been on the market for several weeks and only a few buyers have come to see it—or worse, you haven’t gotten any offers—it could be a clear indication the price isn’t matching up with what buyers expect. Because buyers who have been looking for a while can easily spot (and write off) a home that seems overpriced.

Your real estate agent will coach you through this, so lean on their experience for what you may want to try to bring more buyers in, including considering a price cut.

2. Buyers Have Consistent Negative Feedback after Showings

And if after the showings you do have, comments from the potential buyers aren’t great, you may need to course correct. Feedback from showings is an important part of understanding how buyers see your house. If they consistently say it’s overpriced compared to other homes they’ve seen, it’s time to reconsider your pricing strategy.

Your agent will gather and analyze this feedback for you, so you can look at how your house stacks up in the market. They can also suggest specific improvements or staging changes to better justify your asking price, or recommend one that aligns with today’s buyer expectations. As the National Association of Realtors (NAR) explains:

“Based on all the data gathered, agents may make adjustments to the initial price recommendation. This could involve adjusting for market conditions, property uniqueness, or other factors that may impact the property’s value.”

3. It’s Been on the Market for Too Long

And that lack of interest is ultimately going to lead to it sitting on the market without any serious bites. The longer it lingers, the more likely it is to raise red flags for buyers, who may wonder if something is wrong with it. Especially in today’s market with growing inventory, a long listing period means your house is stale – and that makes it even harder to sell.

Your real estate agent will be able to give you perspective on how quickly other homes in your area are selling and walk you through what’s working for other sellers. That way you can decide together if there’s something you want to do differently. As a Bankrate article says:

“Check with your agent about the average number of days homes spend on the market in your area. If your listing has been up significantly longer than average, that may be a sign to reduce the price.”

4. Your Neighbor’s House Sold Without an Issue

And here’s the last one to watch out for. If similar homes in your area are selling faster than yours, it’s a clear sign that something is off. This could be due to things like a lack of upgrades, outdated features, or a less desirable location. Or, it may be priced too high.

Your agent will keep you up to date on your competition and what changes, if any, you need to make your home more competitive. They’ll offer advice on small updates that could increase your home’s appeal or how to adjust your strategy to reflect the reality of the market today.

Bottom Line

Pricing a home correctly is both an art and a science. It requires a deep understanding of the market and buyer psychology. And when the price isn’t drawing in buyers, there’s no better resource than your agent on what you may want to do next.

The Surprising Amount of Home Equity You’ve Gained over the Years

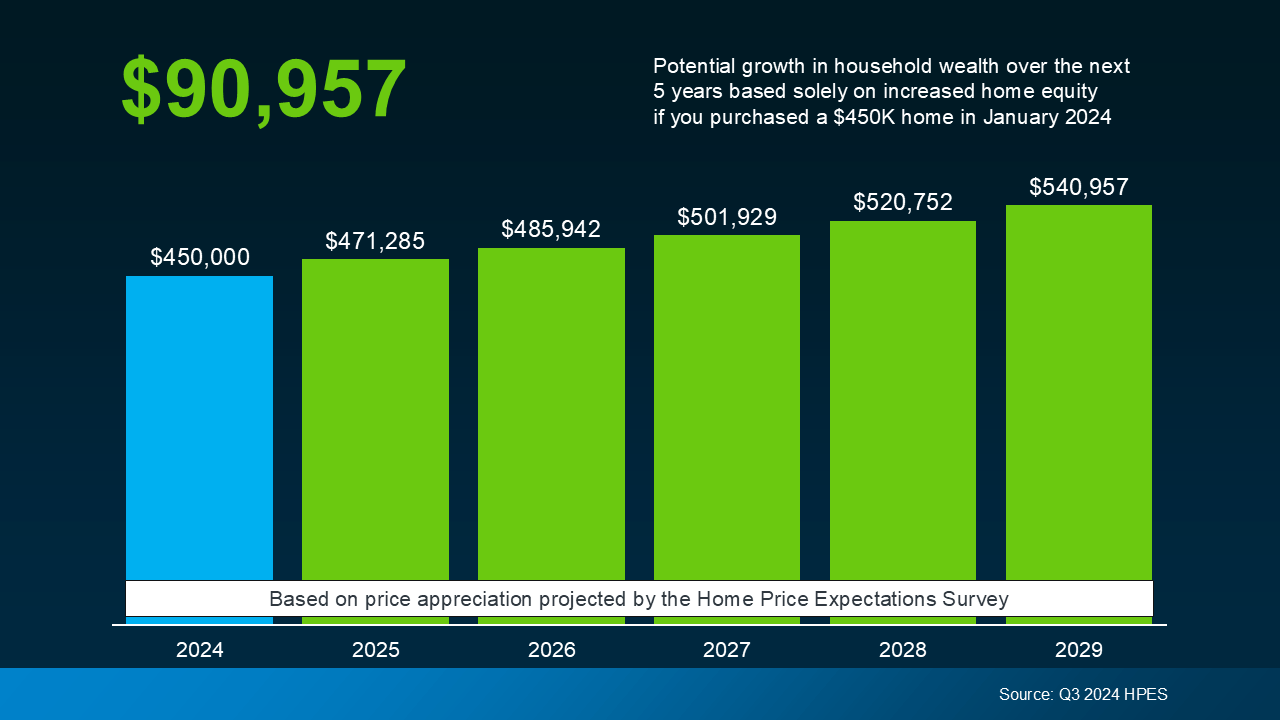

There are a number of reasons you may be thinking about selling your house. And as you weigh your options, you may find you’re unsure how you’re going to deal with one thing about today’s housing market – and that’s affordability. If that’s your biggest concern, understanding how much equity you have in your house could help make your decision that much easier. Here are two key factors that have a big impact on your equity.

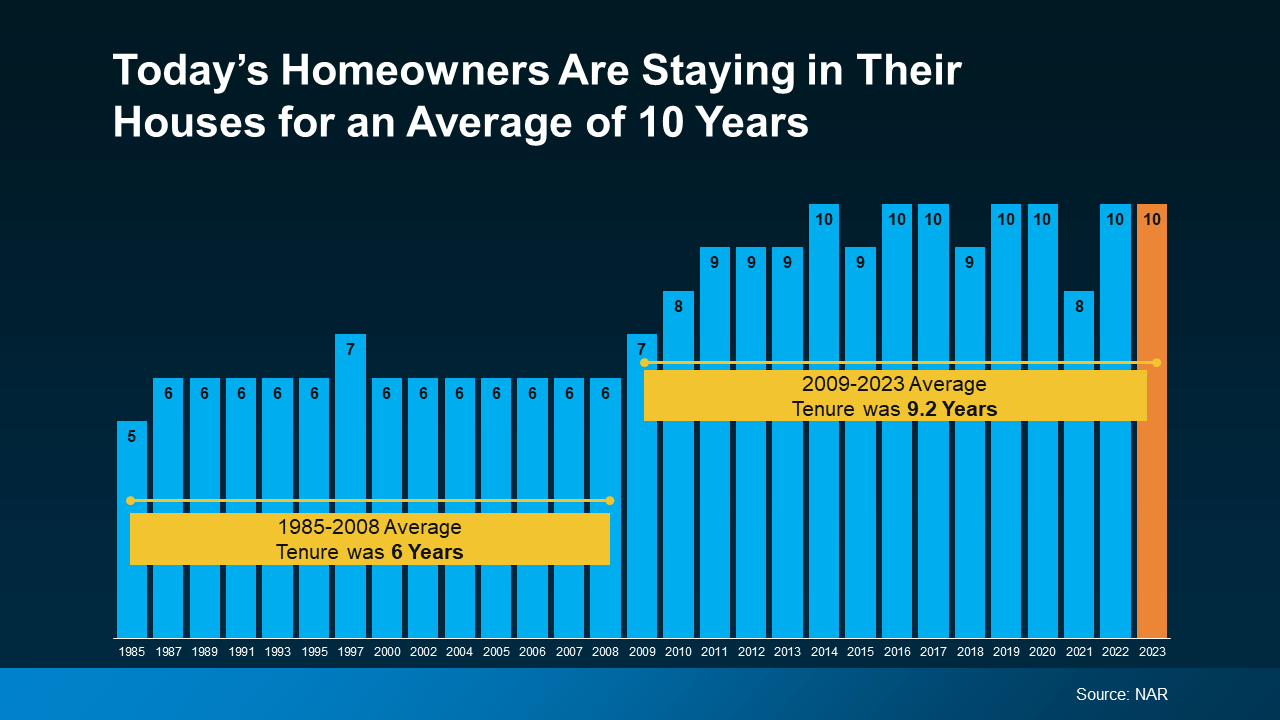

How Long You’ve Been in Your Home

First up is homeowner tenure. That’s how long homeowners live in a house, on average, before selling or choosing to move. From 1985 to 2009, the average length of time homeowners stayed put was roughly six years.

But according to the National Association of Realtors (NAR), that number has been climbing. Now, the average tenure is 10 years (see graph below):

Here’s why that’s such a big deal. You gain equity as you pay down your home loan and as home prices climb. And when you combine all of your mortgage payments with how much prices have gone up over the span of 10 years, that adds up. So, if you’ve lived in your house for a while now, you may be sitting on a pile of equity.

How Home Prices Appreciate over Time

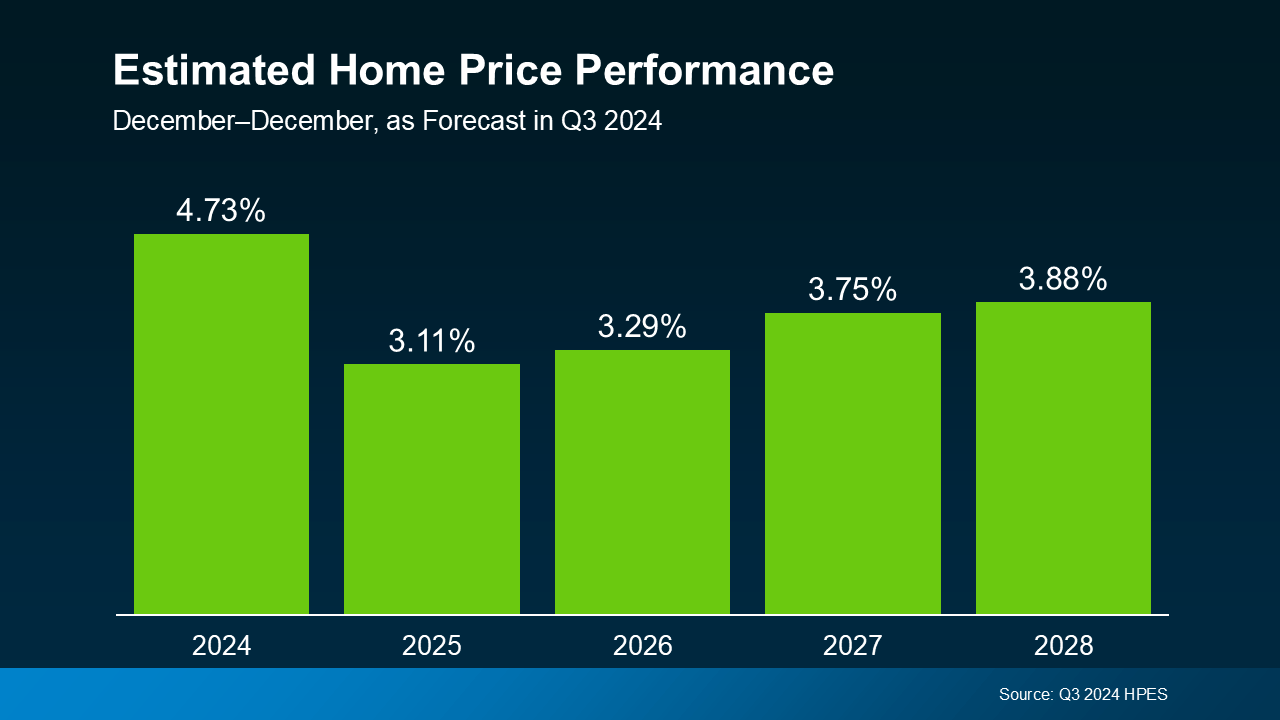

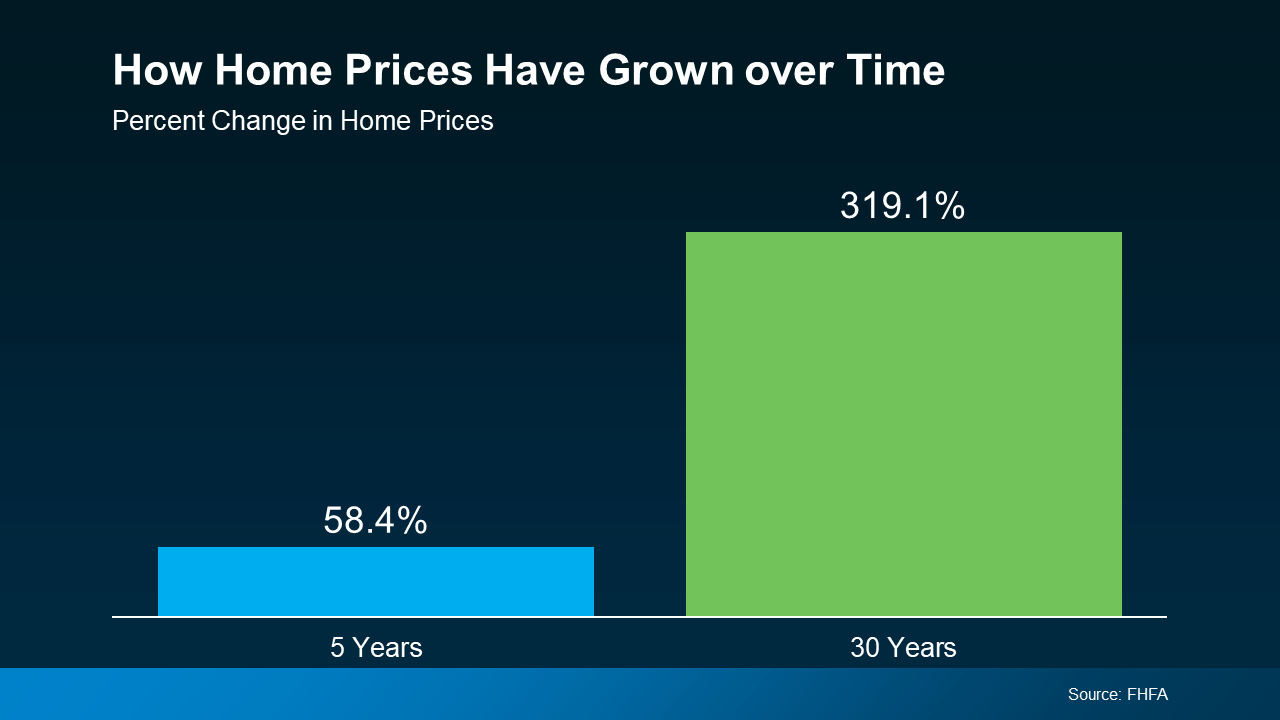

To help show how much the price appreciation piece adds up, take a look at this data from the Federal Housing Finance Agency (FHFA) (see graph below):

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Here’s what this means for you. While home prices vary by area, the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it more than triple in value in that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you can live closer to friends or loved ones, your equity can be a game changer.

Bottom Line

If you want to find out how much equity you’ve built up over the years and how you can use it to buy your next home, let’s connect.

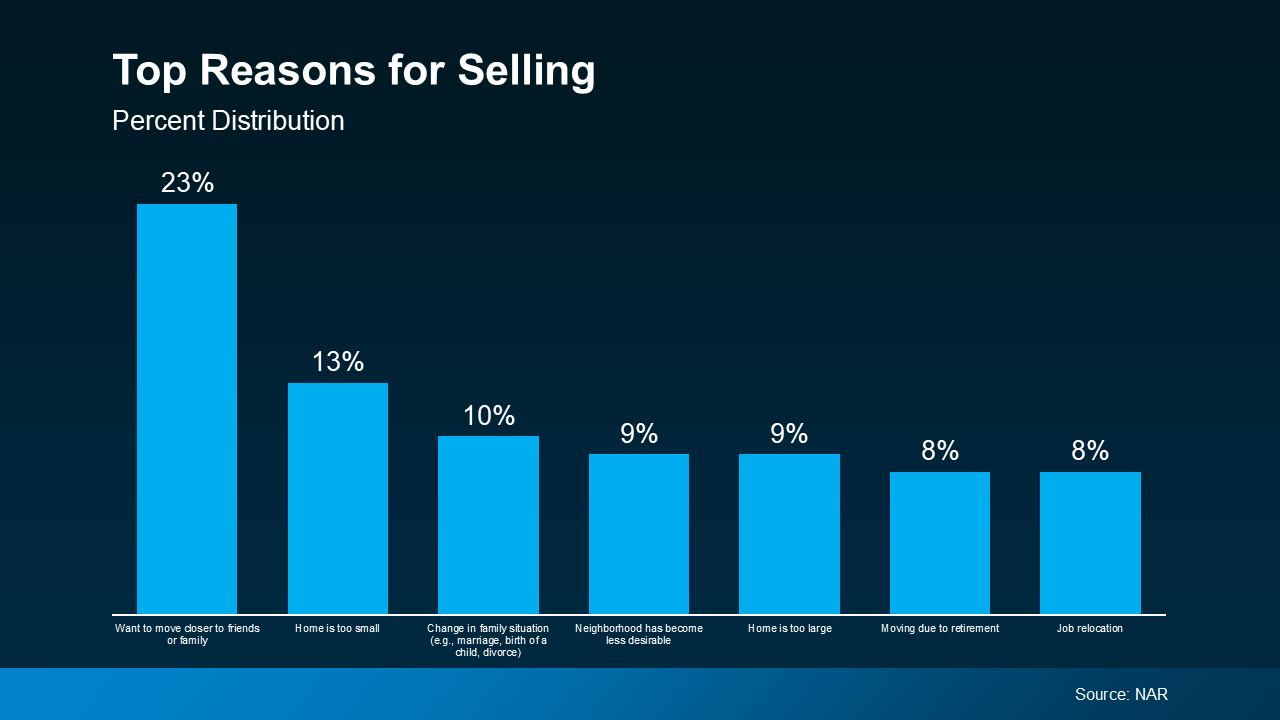

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Bottom Line

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, let’s have a conversation.

What Mortgage Rate Are You Waiting For?

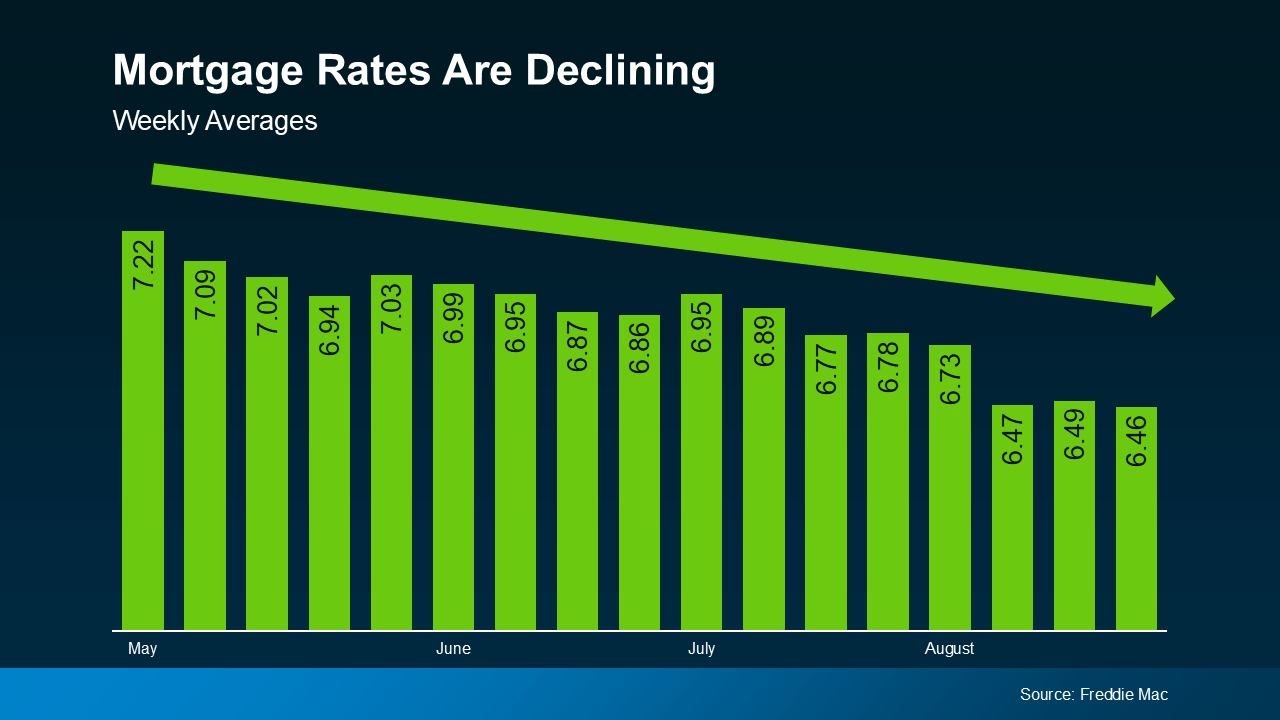

You won’t find anyone who’s going to argue that mortgage rates have had a big impact on housing affordability over the past couple of years. But there is hope on the horizon. Rates have actually started to come down. And, recently they hit the lowest point we’ve seen in 2024, according to Freddie Mac (see graph below):

And if you’re thinking about buying a home, that may leave you wondering: how much lower are they going to go? Here’s some information that can help you know what to expect.

Expert Projections for Mortgage Rates

Experts say the overall downward trend should continue as long as inflation and the economy keeps cooling. But as new reports come out on those key indicators, there’s going to be some volatility here and there.

What you need to remember is it’s not wise to let those blips distract you from the larger trend. Rates are still down roughly a full percentage point from the recent peak compared to May.

And the general consensus is that rates in the low 6s are possible in the months ahead, it just depends on what happens with the economy and what the Federal Reserve decides to do moving forward.

Most experts are already starting to revise their 2024 mortgage rate forecasts to be more optimistic that lower rates are ahead. For example, Realtor.com says:

“Mortgage rates have been revised slightly lower as signals from the economy suggest that it will be appropriate for the Fed to begin to cut its Federal Funds rate in 2024. Our yearly mortgage rate average forecast is down to 6.7%, and we revised our year-end forecast to 6.3% from 6.5%.”

Know Your Number for Mortgage Rates

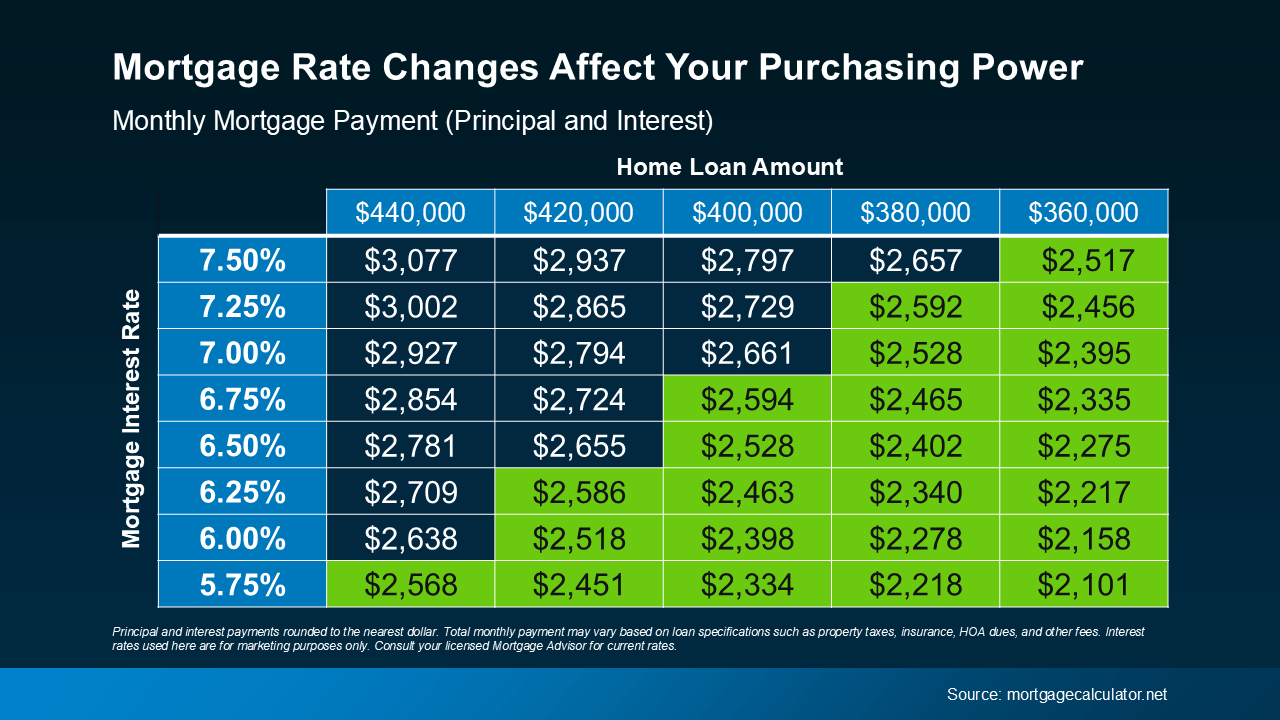

So, what does this mean for you and your plans to move? If you’ve been holding out and waiting for rates to come down, know that it’s already happening. You just have to decide, based on the expert projections and your own budget, when you’ll be willing to jump back in. As Sam Khater, Chief Economist at Freddie Mac, says:

“The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move.”

As a next step, ask yourself this: what number do I want to see rates hit before I’m ready to move?

Maybe it’s 6.25%. Maybe it’s 6.0%. Or maybe it’s once they hit 5.99%. The exact percentage where you feel comfortable kicking off your search again is personal. Once you have that number in mind, you don’t need to follow rates yourself and wait for it to become a reality.

Instead, connect with a local real estate professional. They’ll help you stay up to date on what’s happening and have a conversation about when to make your move. And once rates hit your target, they’ll be the first to let you know.

Bottom Line

If you’ve put your moving plans on hold because of higher mortgage rates, think about the number you want to see rates hit that would make you re-enter the market.

Once you have that number in mind, let’s connect so you have someone on your side to let you know when we get there.

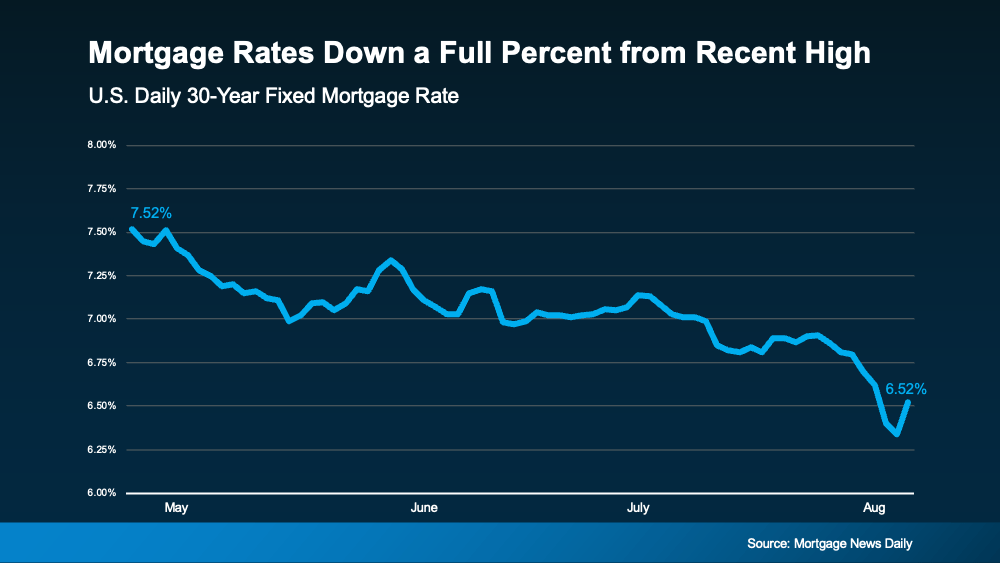

Mortgage Rates Down a Full Percent from Recent High

Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability. And if you’re someone who’s looking to make a move, you’ve probably been waiting eagerly for rates to come down for that very reason. Well, if the past few weeks are any indication, you may be getting your wish.

Mortgage Rates Trend Down in Recent Weeks

There’s big news for mortgage rates. After the latest reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s recent comments, mortgage rates started dropping a bit. And according to Freddie Mac, they’re now at a level we haven’t seen since February. To help show the downward trend, check out the graph below:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.”

And with the decrease in recent weeks, you’ve got a big opportunity in front of you right now. It may be enough for you to want to jump back in.

The Relationship Between Rates and Demand

If you wait for mortgage rates to drop further, you might find yourself dealing with more competition as other buyers re-ignite their home searches too.

In the housing market, there’s generally a relationship between mortgage rates and buyer demand. Typically, the higher rates are, the lower buyer demand is. But when rates start to come down, things change. Buyers who were on the fence over higher rates will resume their searches. Here’s what that means for you. As a recent article from Bankrate says:

“If you’re ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That’s unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.”

Bottom Line

If you’ve been waiting to make your move, the recent downward trend in mortgage rates may be enough to get you off the sidelines. Rates have hit their lowest point in months, and that gives you the opportunity to jump back in before all the other buyers do too.

Should You Rent Out or Sell Your House?

Figuring out what to do with your house when you’re ready to move can be a big decision. Should you sell it and use the money for your next adventure, or keep it as a rental to build long-term wealth?

It’s a question many homeowners face, and the answer isn’t always straightforward. Whether you’re curious about the potential income from renting or worried about the responsibilities of being a landlord, there’s a lot to consider.

Let’s walk through some key questions to ask to help you make the best decision for your situation.

Is Your House a Good Fit for Renting?

Even if you’re interested in becoming a landlord, your current house might not be ideal for renting. Maybe you’re moving far away, so keeping up with the ongoing maintenance would be a hassle, the neighborhood isn’t great for rentals, or the house needs significant repairs before you could rent it out.

If any of this sounds like it might apply, selling might be your best option.

Are You Ready for the Realities of Being a Landlord?

Managing a rental property isn’t just about collecting rent checks. It’s a time-consuming and sometimes challenging job.

For example, you may get calls from tenants at all hours of the day with maintenance requests. Or you may find a tenant causes damage you have to repair before the next lease starts. You may even have to deal with people falling behind on payments or breaking their lease early. Investopedia highlights:

“It isn’t difficult to find horror stories of landlords troubled with more headaches than profits. Before deciding to rent, consider talking to other landlords and doing a detailed cost analysis. You might find that selling your home is a better financial decision and less stressful.”

Do You Have a Good Understanding of What It’ll Cost?

If you’re thinking about renting out your home primarily to generate extra income, remember that there are additional costs you’ll want to plan for. As an article from Bankrate explains:

- Mortgage and Property Taxes: You still need to pay these expenses, even if the rent doesn’t cover all of it.

- Insurance: Landlord insurance costs about 25% more than regular home insurance, and it’s necessary to cover damages and injuries.

- Maintenance and Repairs: Plan to spend at least 1% of the home’s value annually, more if the home is older.

- Finding a Tenant: This involves advertising costs and potentially paying for background checks.

- Vacancies: If the property sits empty between tenants, you’ll lose rental income.

- Management and HOA Fees: A property manager can ease the burden, but typically charges about 10% of the rent. HOA fees are an additional cost too, if applicable.

Bottom Line

To sum it all up, selling or renting out your home is a personal decision that depends on your circumstances. Whatever you decide, taking the time to evaluate your options will help you make the best choice for your future.

Make sure to weigh the pros and cons carefully and consult with professionals so you feel supported and informed as you make your decision. That’s what we’re here for.

Are Home Prices Going To Come Down?

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Here’s what Danielle Hale, Chief Economist at Realtor.com, says:

“In stock market terms, a correction is generally referred to as a 10 to 20% drop in prices . . . We don’t have the same established definitions in the housing market.”

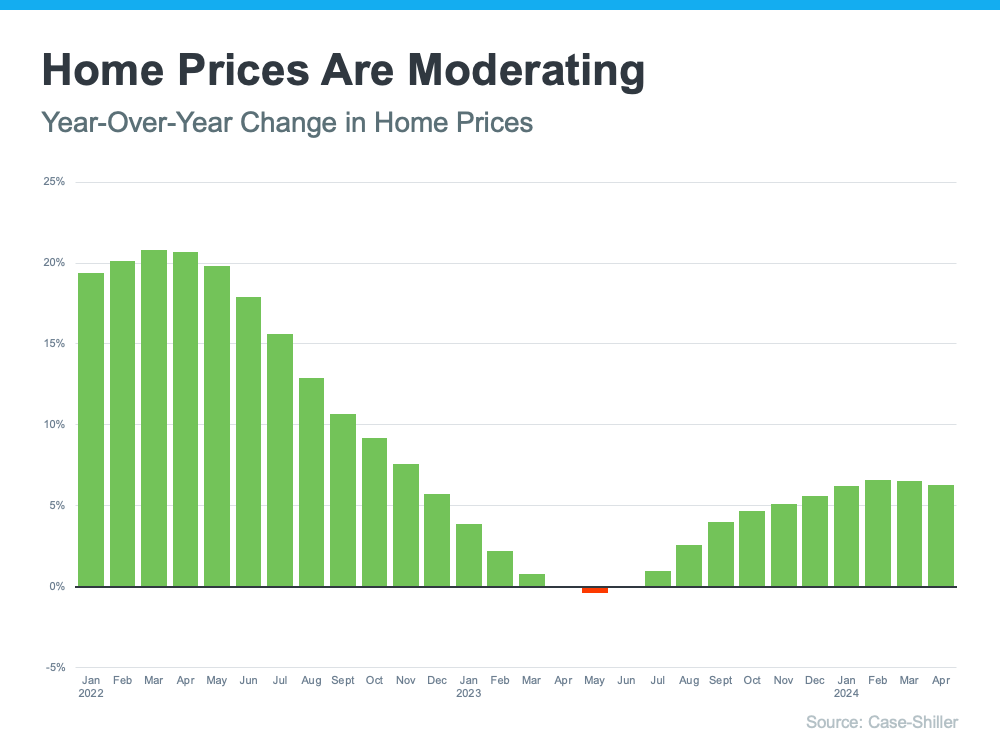

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices, which have been increasing rapidly over the last couple years, are normalizing a bit. In other words, they’re now growing at a slower pace. Prices vary a lot by local market, but rest assured, a big drop off isn’t what’s happening at a national level.

The Real Estate Market Is Normalizing

From 2020 to 2022, home prices skyrocketed. That rapid increase was due to high demand, low interest rates, and a shortage of homes for sale. But, that kind of aggressive growth couldn’t continue forever.

Today, price growth has started to slow down, which is a sign the market is beginning to normalize. The most recent data from Case-Shiller shows that after being basically flat for a couple of months last year, prices are going up at a national level – just not as quickly as before (see graph below):

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Of course, that’s what’s happening now, but you may be wondering what’s next for prices. Marco Santarelli, the Founder of Norada Real Estate Investments, says:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It’s all about supply and demand. Increasing inventory plus limited buyer demand, due to relatively high mortgage rates, will continue to ease some of the upward pressure on prices.

What This Means for You

If you’re thinking about buying a home, slowing price growth is welcome news. Skyrocketing home prices during the pandemic left many would-be homebuyers feeling priced-out.

While it’s still a good thing to know the value of the home you buy will likely continue to go up once you own it, slowing price gains are making things feel more manageable. Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn’t boarded up just yet.”

Bottom Line

At the national level, home prices are not going down. And most experts forecast they’ll continue growing moderately moving forward. But prices vary a lot by local market. That’s where a trusted real estate agent comes into play. If you have questions about what’s happening with prices in our area, reach out.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link